It’s Tax Season: Watch Out for These 9 Scams

Tax season is like Christmas for cybercriminals, and not being aware of what to look out for could result in you losing money, data, or having your identity stolen. 8 Phishing Scams Phishing is one of the oldest tricks in the book, and you'll need to be on high alert during the tax season. Scams from people claiming to be the IRS can look surprisingly legitimate; you'll often see the expected date that you need to send a form, for example. You often have to look more closely at these kinds of scams. In the example below, you can see that the email sender has a New Zealand address. You should also look out for the language used. When the IRS owes you money, you'll see a tax refund form, not a return (as visible in the above message). Moreover, you will be notified by post instead of email if you receive a refund. 7 Fake IRS Phone Calls

Tax season is like Christmas for cybercriminals, and not being aware of what to look out for could result in you losing money, data, or having your identity stolen.

8 Phishing Scams

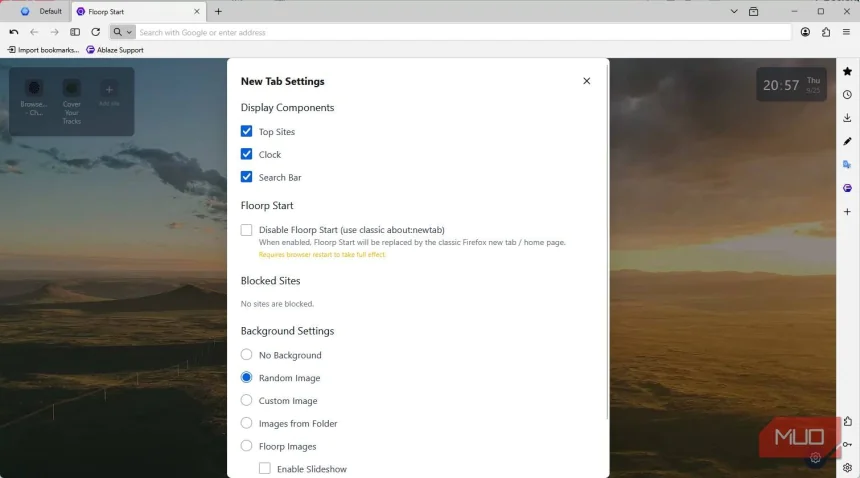

Phishing is one of the oldest tricks in the book, and you'll need to be on high alert during the tax season. Scams from people claiming to be the IRS can look surprisingly legitimate; you'll often see the expected date that you need to send a form, for example.

You often have to look more closely at these kinds of scams. In the example below, you can see that the email sender has a New Zealand address.

You should also look out for the language used. When the IRS owes you money, you'll see a tax refund form, not a return (as visible in the above message). Moreover, you will be notified by post instead of email if you receive a refund.

7 Fake IRS Phone Calls

During tax season, beware of people claiming to be someone from the IRS when calling you. The person often tries to cause panic by saying you owe the IRS money. Then, they'll ask you to pay or provide your banking information.

Though being indebted to the tax authorities can feel daunting, avoid sending money if this happens to you. You can always verify using the IRS's official contact details; while you may still owe them money, you'll at least be certain.

You should also understand how to know when a scammer is calling you. Signs include fake legal threats and being rude or aggressive.

6 Smishing Scams

Smishing scams are similar to phishing, except that someone will try to extort money from you via SMS instead of email. You may receive fake messages saying you owe taxes, typically with a dangerous link that takes you to a payment platform.

Even if you don't submit any payment details, clicking on these links can download malware onto your device. So, you shouldn't go near them. Thankfully, spotting smishing texts is easy these days. For example, IRS SMS messages that you can reply to should be ignored; the IRS never sends texts to its citizens.

5 Client Outreach Scams

Filing tax returns is stressful, but helpful software tools and accountants exist. However, you should find these yourself rather than relying on people who send you outreach emails.

Not every person who sends an outreach email is a scammer, but you should be very careful before interacting. Some people will use client outreach scams to "offer" accounting services but not actually deliver on what they say.

4 Wire Transfer Scams

Although wire transfers are a common way to send money these days, doing so during the tax season can lead to bad consequences. Sometimes, scammers will impersonate the IRS and ask you to send them money via this method.

Since the IRS doesn't ask you to wire transfer them money, you can be certain that someone's trying to scam you. The same goes for other requested payments via prepaid credit cards or gift cards. Again, you can always contact the IRS's official helplines if you owe money.

If you've already paid someone using a wire transfer, inform your bank immediately to avoid further damage.

3 Impersonation Scams

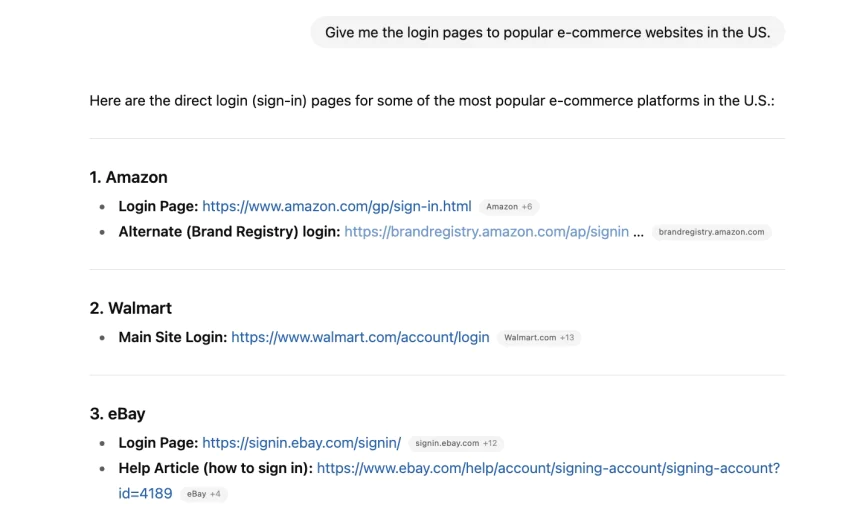

IRS impersonation scams are commonly associated with phishing and smishing, but you should be careful either way. One malicious way criminals might try to get money from you is via fake websites pretending to be the IRS.

The IRS's official website is irs.gov, and you should always ensure that you've included this in your URL bar. Be careful of typos and no padlock icons, in particular.

Occasionally, you might receive emails from someone claiming to be the IRS with a link. While these might not take money from you, they could download malware onto your device. So, you should be extra careful. Avoiding the most common sources of malware is also a good idea.

2 SSN and Tax ID "Requests"

Your social security number is one of the most valuable forms of personally identifiable information (PII) and should be protected at all costs. Scammers may try to get this and your tax ID number from you, and you must be on particularly high alert during tax season.

Scammers may ask for your SSN or tax ID number via email, phone, or letter. Before doing anything, double-check with the IRS. While you need this information to fill out your tax return forms, it's not necessary in many other cases.

If scammers get your SSN, they can use it for several forms of identity theft. So, besides keeping it safe during tax season, you should avoid telling others unless it's absolutely necessary.

It's normal for someone preparing your taxes to ask for your SSN. The problem instead lies with giving this information to random people who have just emailed you.

1 Fake Stimulus Payments

Scammers might claim that the IRS wants to give you a stimulus check before redirecting you to a malicious website. Here, you're then asked to submit your personal information. Sadly, the website will look similar to the official IRS version, designed to trick you into giving up your private data.

The scammer will claim that you'll receive your stimulus payment within a few business days, but of course, it'll never arrive.

While sinister, this scam is easy to identify. The scam relates to people who didn't receive full stimulus checks during COVID-19. However, these payments are automatically sent to the eligible 1 million recipients. Moreover, those who will get these checks will receive a letter in the post.

Tax season scams are varied, and staying on high alert is essential. To minimize the risk of becoming a victim, you'll need to be on high alert throughout the entire period and pay specific attention to any mail, messages, or contact allegedly from the IRS—it's the primary way these tax season scams work!

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0